⭐【🇧🇩孟加拉社會企業海外見習】 Day 2 ⭐

Bangladesh Social Business Internship Visit-Day 2

–

📌2月3日-格萊珉銀行總部@達卡

Feb. 3rd- Grameen Bank (Dhaka, Bangladesh)

–

📚第二天一早,Grameen Bank (格萊珉銀行)國際計畫部門首席 Golam MORSHED Mohammed為我們簡介格萊珉銀行,並由管理部門負責人Khir與Abul協助回答我們對於格萊珉銀行的疑問。

In the morning of the second day, Golam MORSHED Mohammed, from the AGM& Faculty Chief International Program Department, introduced Grameen bank to us. At the same time, Khir and Abul, the department leader, helped Golam answer the questions we brought up.

–

🇧🇩先從這個有趣的命名和Logo說起吧!

在孟加拉語中,Grameen有「village 鄉村」的意涵,而Grameen Bank便是大家平常所說的「鄉村銀行」。

Logo雖然看似是一間房子,但它其實是一個朝上的箭頭,象徵著向上的力量,顏色取自孟加拉的國旗色-綠色與紅色。

Let’s introduce its interesting name and Logo firstly! In Bangladesh, “Grameen” means “village”, so “Grameen Bank” is also called “village bank”. The Logo looks like a house but actually it is an upwards arrow which symbolizes positive power. The color is from the national flag of Bangladesh – red and green.

–

🎤格萊珉銀行為什麼創立呢?

孟加拉是在1971年從巴基斯坦獨立出來的新興國家。經濟學家尤努斯.穆罕默德博士看見人民因缺乏抵押品而無法向銀行借貸,乃至無法購買原料生產產品販賣,陷入極度貧窮的困境中。因此博士在1976年創立了格萊珉銀行,希望可以解決富人恆富,窮人無法脫貧的社會問題。

So why Professor Muhammad Yunus established Grameen Bank. Bangladesh is an emerging country, which divided from Pakistan in 1971. Professor Muhammad Yunus, economist from Chittagong University, found out that poor people couldn’t acquire loans from bank simply due to the lack of collaterals. This became a vicious cycle that poor people couldn’t even buy the raw materials to run small business. Consequently, Professor Yunus established Grameen Bank in 1976 in order to solve the social problem that the rich remain wealthy and the poor remain in poverty.

–

🌞格萊珉銀行創立的目標與願景

尤努斯博士希望藉由提供全面的財務服務,讓窮困的人可以發揮他們的潛在能力,並打破窮困的惡性循環。並抱持著三個願景:

1. 消滅貧窮,並遠離窮困

2. 為獲得收入和知識進行資訊科技與通訊的整合

3. 為未來世代提供教育和知識,避免家人重回貧困

Mission and Vision of Grameen Bank

Dr. Yunus hope that by providing comprehensive financial services, empowering the poor to realize their potential and break out of the vicious cycle of poverty.

There are three visions:

1. Eradicate and Stay Away From Poverty.

2. Integration of IT & Communications for income and knowledge.

3. Prepare the future generation with education and knowledge so that the families do not slip back into poverty.

–

📚短暫的午休過後,跟著Golam的腳步來到了尤努斯博士諾貝爾獎的展示迴廊,了解尤努斯博士在一路上的心路歷程和創始時期的手稿,以及格萊珉銀行的紀錄片。

After a short break, we followed Golam to the gallery of Nobel prize of Yunus. The gallery showcases what Yunus has done along the way and the hand-writing scripts of him at the founding period. Besides, there is also a documentary about Grameen bank.

–

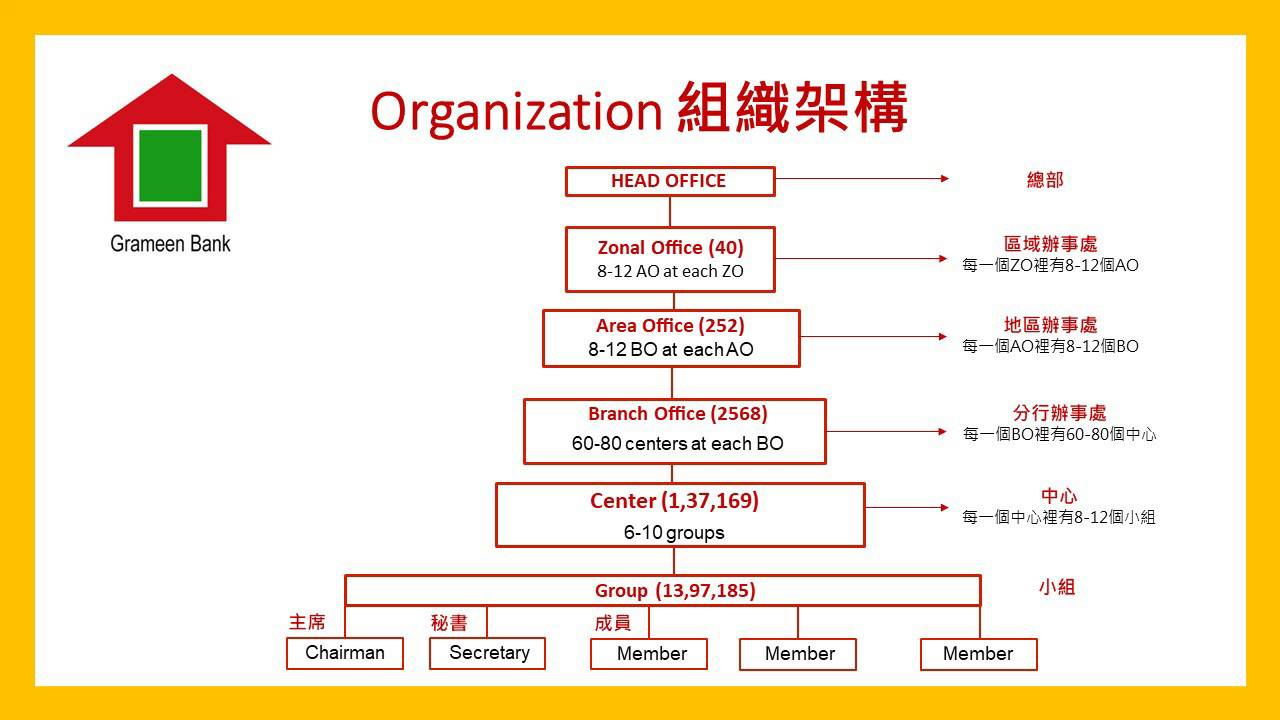

🎤格萊珉銀行主要以什麼樣的形式協助窮人呢?

下午的課程由Md. Humayun和Md. Abdus與大家細談格萊珉銀行的主要業務-借貸和儲蓄,協助沒有金援的窮人有資金開啟事業,有少許積蓄的民眾可以累積財富獲取存款利息。

與一般商業銀行不同的是,商業銀行只會借款給具有信用紀錄且有積蓄的民眾,但格萊珉銀行卻是不借錢給有錢人,選擇協助窮人予以機會置產。以每週償還少量本金與利息的方式,和借款人會面,並予以協助,給予借款人持續還錢和工作的動力。

In what way does the Grameen Bank help the poor?

In the lecture given by Md. Humayun and Md. Abdul in the afternoon, we talked about the main services of the Grameen Bank — loaning and saving. They help the poor people without capital to start their business and the people with some savings build up wealth to gain the interest. In general, commercial banks only provide loans for people with credit and savings. On the other hand, Grameen Bank only lend money to poor people, aiming to help them to own assets. The Grameen Bank encourages the borrowers to pay back the money by letting them pay back a little amount of the money each week and having the bank workers meet directly with the borrowers every week to provide assistance.

–

🚀當然! 格萊珉銀行提供多種不同的貸款和儲蓄的業務,像是就業貸款、房屋貸款、個人儲蓄、借貸保險儲蓄等產品,明天我們會前進鄉村,直接和當地銀行與借款民眾面對面訪談! 讓我們期待明天格萊珉銀行與孟加拉居民最真實的故事!🤩

Of course, Grameen Bank provides many different loans and saving products, such as basic loan, house loan, personal deposits, loan insurance saving fund, etc. Tomorrow, we will walk into village, visiting local branch offices of Grameen Bank and borrowers! Let us look forward to the authentic stories about Grameen Bank and Bangladeshis tomorrow!🤩

–

#socialbusiness

Grameen Bank

–

圖文引用請註明【國立中央大學尤努斯社會企業中心】